Manny Khoshbin: The Intersection of Discipline, Fitness, and Entrepreneurial Resilience

Manny Khoshbin: The Intersection of Discipline, Fitness, and Entrepreneurial Resilience

Early Foundations: From Humble Beginnings to American Ambition

Manny Khoshbin’s journey, marked by both financial success and relentless self-discipline, began far from the glitz of his current life. Arriving in the United States from Iran at age 14, he embraced the ethos of “earning what you want” through hard work. By age 17, after months of stocking shelves and mopping floors at Kmart, he saved $5,000 to purchase a 1983 Honda Accord—a milestone he credits as the cornerstone of his “Honda Accord mindset”: prioritizing practicality, resilience, and long-term value over excess.

His introduction to fitness mirrored this philosophy. At 15, he impulsively bought a $2 pair of dumbbells at a swap meet, an investment that would shape his physical and mental trajectory. Inspired by 1980s action icons like Arnold Schwarzenegger and Sylvester Stallone—whose movies taught him “starting from nothing” was achievable—Khoshbin immersed himself in bodyweight exercises, situps, and pullups, principles he still adheres to today.

Fitness as a Catalyst: Discipline Over Extravagance

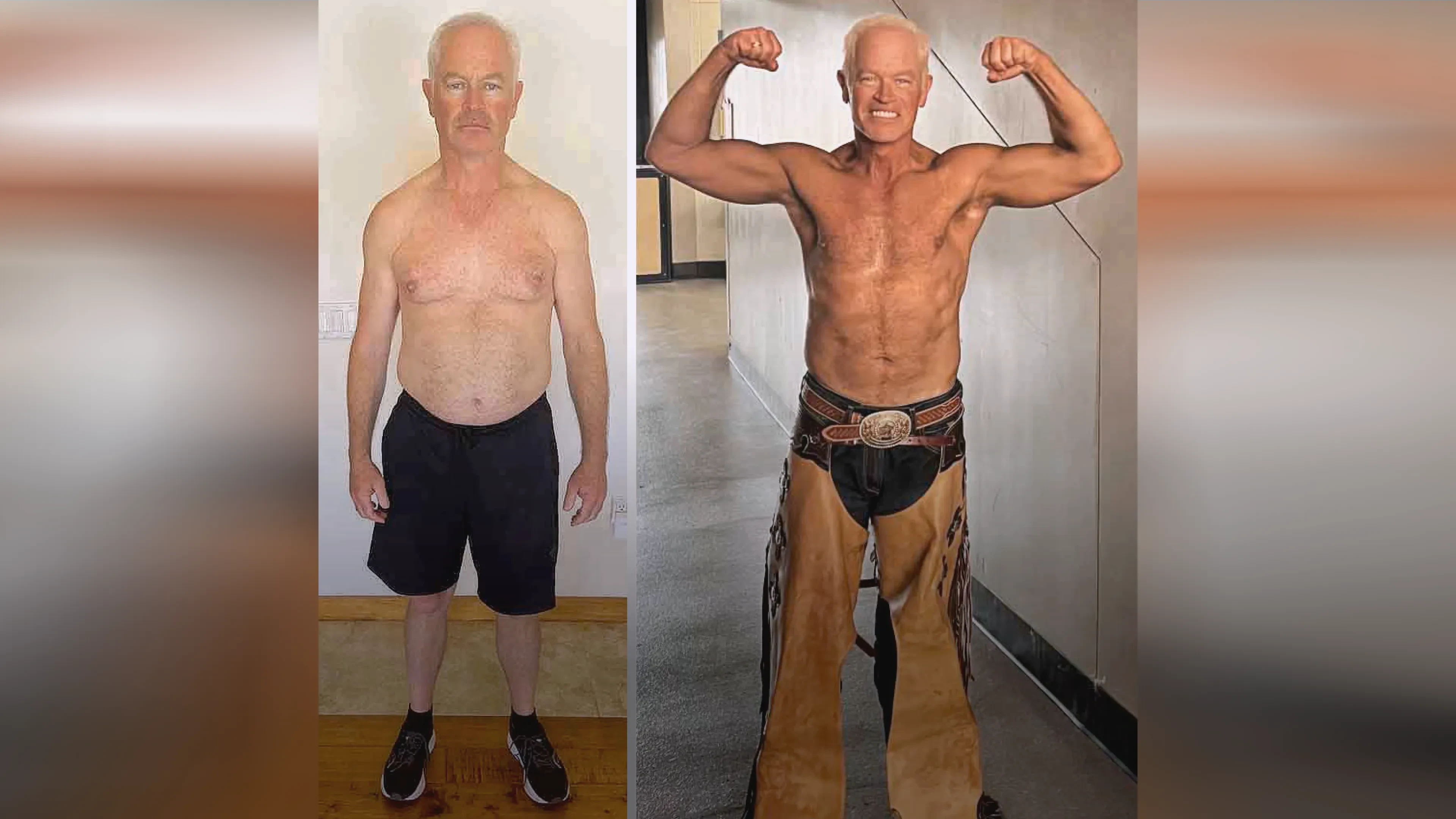

At 54, Khoshbin’s garage gym—equipped with dumbbells, a leg press, and cable machines—blends functionality with his prized supercar collection, but his training philosophy remains rooted in old-school simplicity. His daily routine begins with pullups, a staple he calls “the foundation of my workout regimen,” followed by circuit training and core work. “Pullups and situps are non-negotiable,” he asserts. “They build the strength and discipline that translate to life’s bigger challenges.”

Fitness, for Khoshbin, is not merely physical—it is a mental discipline. “Working out and looking at my cars makes it more enjoyable, but the real value is the resilience it fosters,” he explains. This ethos is echoed in his books Driven and Contrarian Playbook, which emphasize that gym discipline mirrors the perseverance needed to overcome business setbacks.

Business Resilience: Lessons in Adversity

Khoshbin’s entrepreneurial journey was marked by setbacks that tested his resolve. At 19, he lost $20,000—a life savings—after being swindled by a fraudulent investor in a gas station deal. “I had to start over from zero,” he recalls. Yet, he channeled this failure into daily gym sessions, using the grind of lifting weights to manage stress.

A second venture—a neighborhood supermarket—collapsed due to external circumstances, forcing him to work 24/7 to sell the struggling business. “Instead of giving in, I stuck to my routines,” he notes. “Sleepless nights and relentless effort became my discipline, a practice I still apply today.” These experiences solidified his belief that consistency—whether in workouts or business—builds the resilience to bounce back.

Current Practices and Philanthropy

Today, Khoshbin balances luxury with frugality: he splurges on custom car parts but opts for $20 haircuts at Supercuts. His fitness regimen includes creatine supplementation, 20-minute saunas followed by cold showers, and occasional cheat meals, while his priority remains family time—he plans quarterly vacations to bond with his children.

Through his YouTube channel and social media, Khoshbin shares his journey, aiming to inspire young entrepreneurs. “I don’t monetize my content; I share victories and failures to show success is possible for anyone,” he says. His real estate empire and multimillion-dollar car collection are secondary to the lessons he imparts: “Fitness saved me from bankruptcy, and discipline built the mental toughness to rebuild my life.”

Conclusion: A Model of Discipline

Manny Khoshbin’s story underscores that true wealth lies not in assets, but in the habits cultivated through discipline. From $2 dumbbells to a world-class garage gym, his journey illustrates that resilience—whether in the gym or the boardroom—starts with small, consistent choices. As he approaches 55, he remains committed to both physical and professional growth, proving that the greatest “investment” is the one you make in yourself.